Investors have grumbled about US tech valuations for years, and the so-called “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) are the main target.

No one expects companies like Nvidia, Microsoft, or Tesla to trade at the same valuations as average firms. They grow faster, generate superior returns on capital, and have more optionality. The debate is how large the valuation premium should be.

With markets jittery in 2025 and tech stocks wobbling, the question has again become urgent.

Where the Speculation Really Is

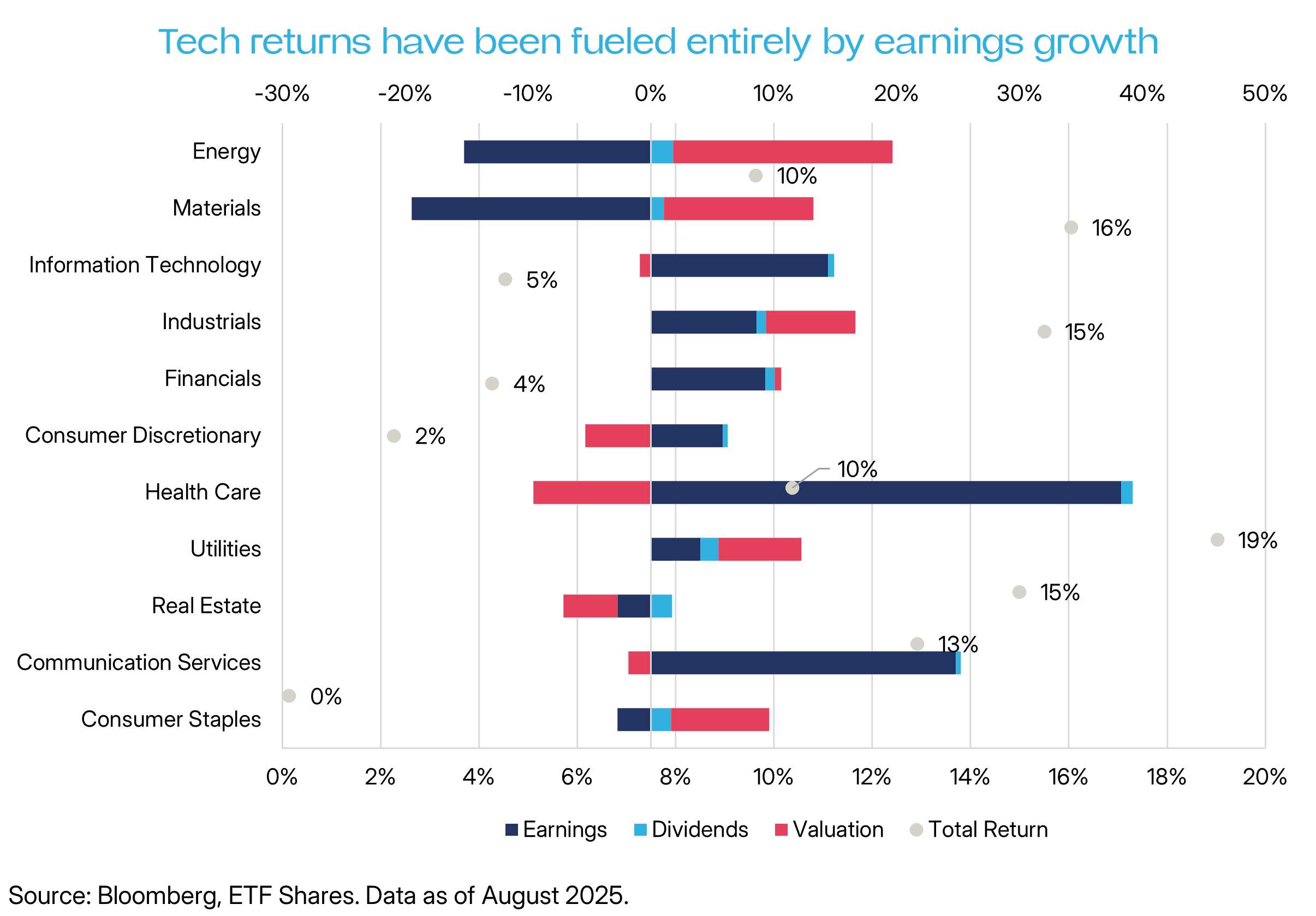

Sceptics often assume US tech’s outsized gains are driven by hype. But examining where multiples have expanded in 2025 tells a different story.

Data shows that industrials and utilities – not technology – have seen the most speculative inflows.

- Industrials: Investors have piled into defence stocks, reflected in large inflows to defence-themed ETFs (which are essentially industrials funds with a marketing twist).

- Utilities: The most bond-like sector has rallied on hopes of grid expansion to support AI demand.

By contrast, technology and communications services – home to six of the Magnificent 7 – have experienced below-average multiple expansion this year. This suggests hype is not what’s driving their valuations higher.

PE Ratios (If You Insist)

Price/earnings ratios are a blunt tool. They ignore both growth rates and optionality – the very traits that make the Mag 7 different.

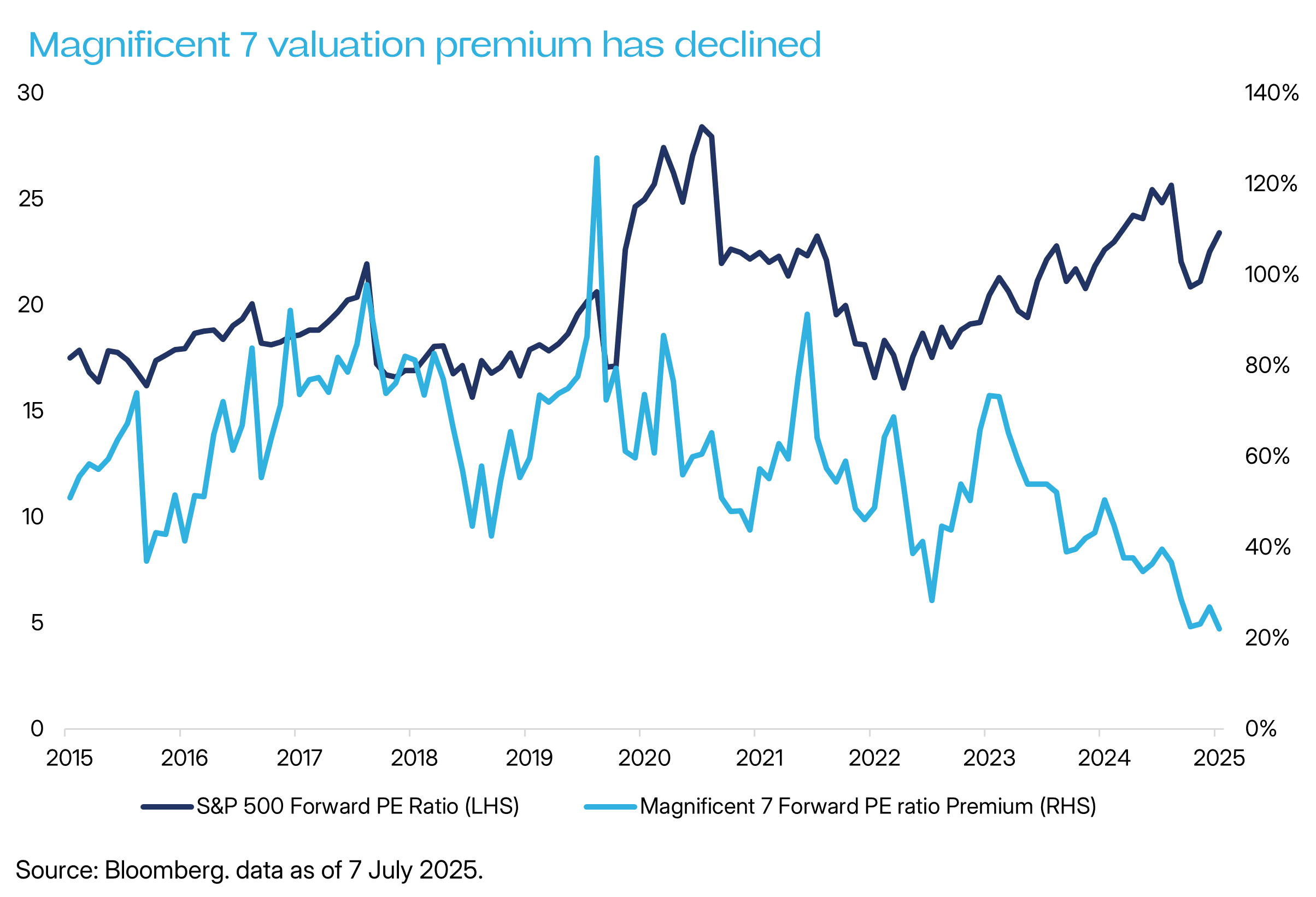

Still, looking at PE ratios relative to the market:

- The Mag 7 currently trade at about a 25% premium to the S&P 500.

- That premium is below the 5-year average of ~40%.

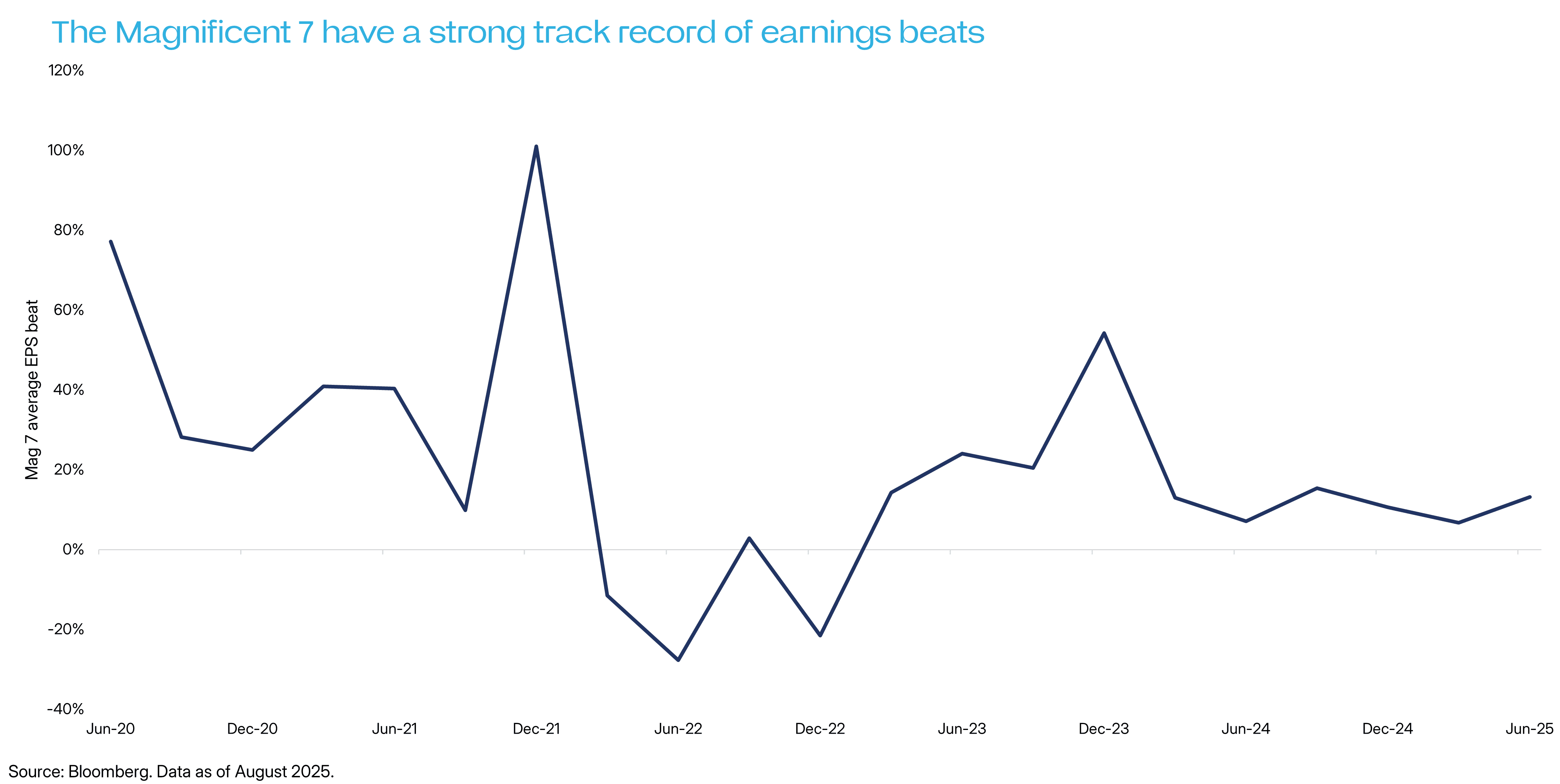

More importantly, the premium has been shrinking since 2021. Earnings have risen faster than multiples, leading to consistent upside earnings surprises – despite analysts already baking in high expectations.

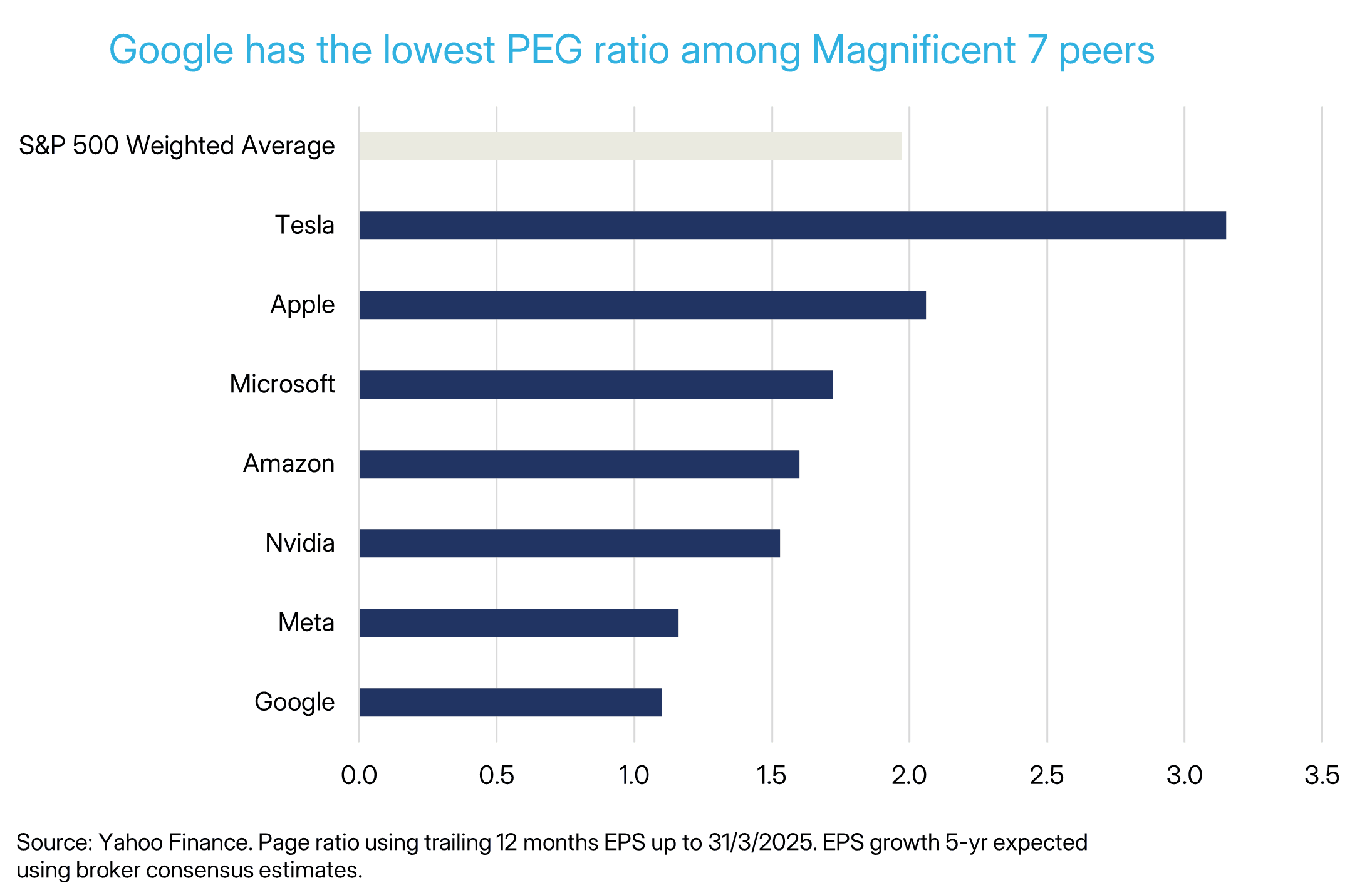

When adjusting for growth via PEG ratios (PE divided by expected EPS growth), most of the Mag 7 trade at or below the market average. The exceptions are Apple, which has struggled with growth, and Tesla, whose valuation is high. Consensus forecasts therefore suggest valuations, while not cheap, are far from bubble territory.

History Doesn’t Show Mean Reversion

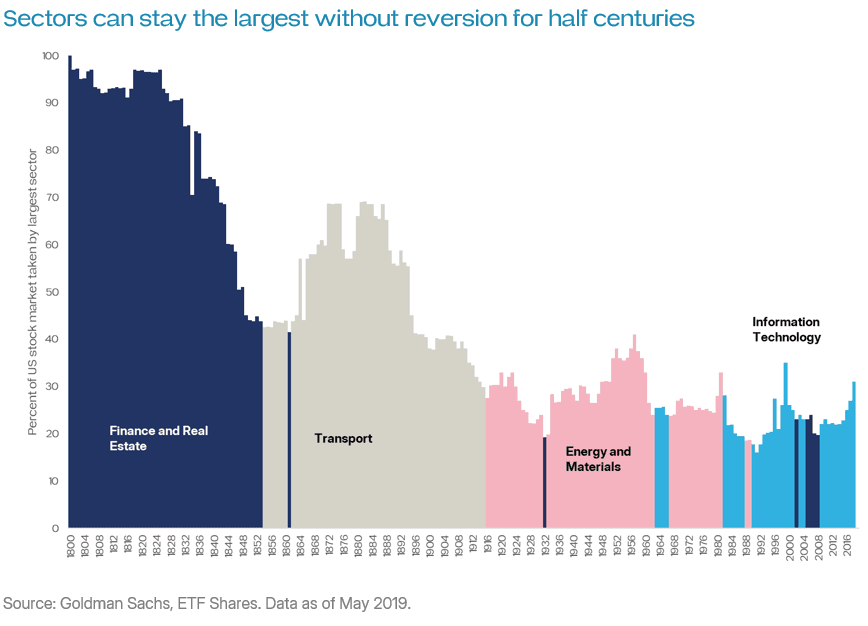

A common objection is that the Mag 7 “must” eventually revert to average returns because nothing outperforms forever. History, however, shows otherwise.

Goldman Sachs research on the US equity market over the past 225 years finds that sector dominance typically lasts around 50 years. What ends it isn’t mean reversion but structural change.

- In the mid-19th century, real estate and finance were dominant, partly tied to slavery. That collapsed permanently during the Civil War.

- In the 1910s, transport lost its edge as the US shifted to cars and suburbs.

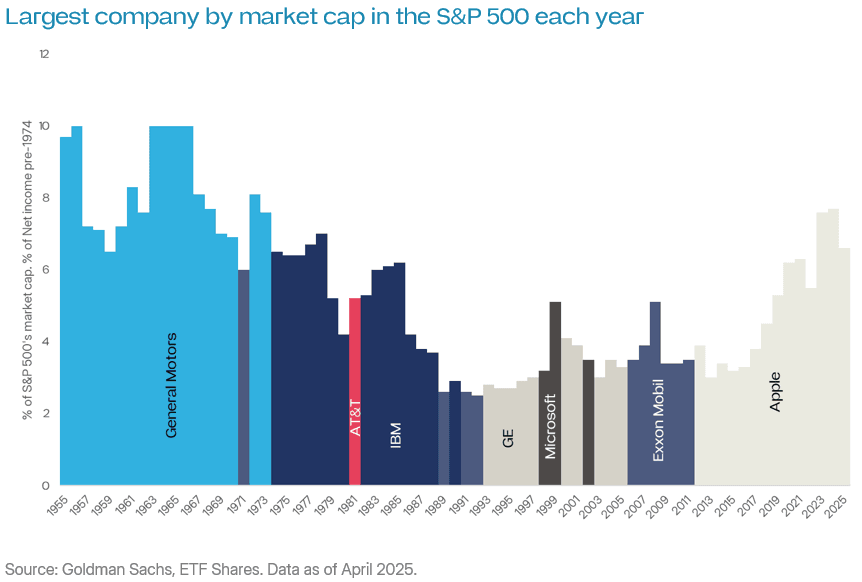

The same holds for companies. Microsoft became the largest US stock in 1998 and is still second largest today – outperforming for nearly three decades. ExxonMobil, tracing back to Rockefeller’s Standard Oil, has been among the largest US firms for over 130 years while continuing to deliver competitive returns.

In other words, sector and stock leadership often persists for decades without mean reversion.

The Legacy of The Big Short

Part of today’s scepticism traces back to Michael Lewis’s The Big Short and its film adaptation. Both fuelled a healthy cynicism about Wall Street, but also a tendency to call everything a bubble.

Yet conditions today are different from both the 2000 dotcom bubble and 2008 mortgage bubble. The scandals that fuelled the dotcom bubble (brokers pushing stocks to mum and dads for commissions) and the housing bubble (toxic teaser loans) have been curbed by regulation. Corporate governance and investor protections have improved substantially.

Ironically, persistent cynicism may be why US tech remained undervalued relative to its growth. Investors are wary of being fooled again – but in the process, they underestimate just how resilient and profitable the leading US tech firms have become.

Conclusion

The Magnificent 7 are not cheap, nor should they be. But the evidence does not support the claim they are overvalued. Valuation premiums have narrowed, earnings continue to surprise on the upside, and history suggests leadership can endure for decades when supported by structural change.

For investors, the burden of proof lies not with those holding these stocks, but with those insisting that US tech is a bubble waiting to burst.

Disclaimer

ETF Shares Management Limited ABN 77 680 639 963, AFSL: 562766. Investing involves risk and returns are not guaranteed. Before investing, you should consider seeking independent advice and read the relevant PDS and TMD available at www.etfshares.com.au